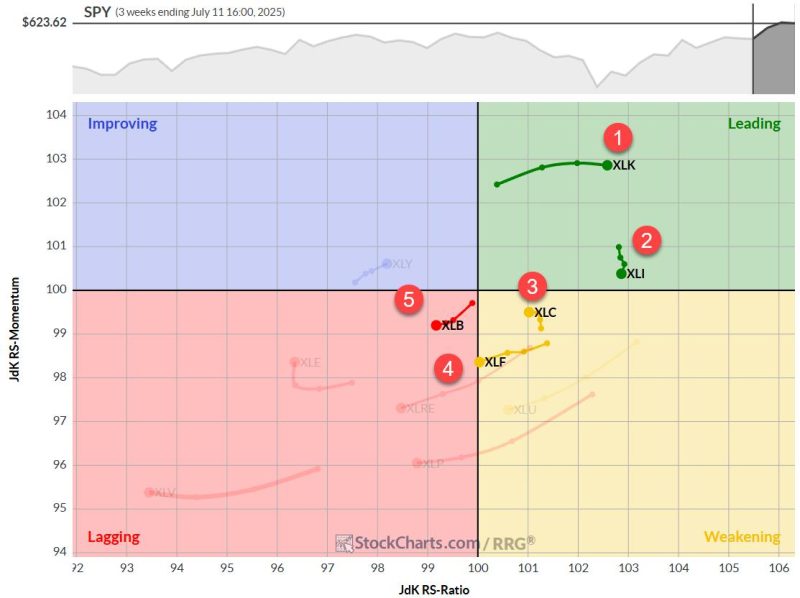

Four Symbols, One Big Message: What the Charts are Telling Us

July 17, 2025

From the S&P 500’s pause within a bullish trend, to critical support levels in semiconductors, plus bullish breakouts in Ethereum and Bitcoin, Frank highlights how the market’s recent consolidation may lead to major upside. In this video, Frank explores how to use StockCharts to layer chart annotations, trend indicators, and pattern analysis for stronger evidence-based […]